Return on owner's investment formula

Return on Investment 2001000 20. Ad TD Ameritrade Investor Education Offers Immersive Curriculum Videos and More.

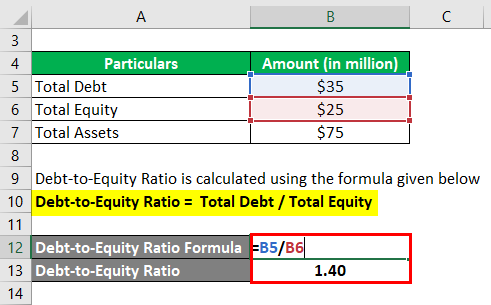

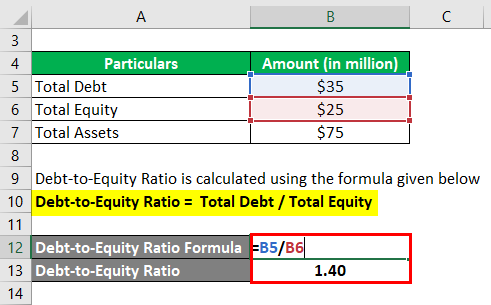

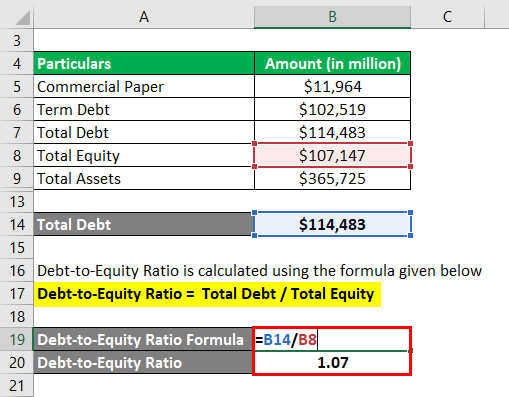

Gearing Formula How To Calculate Gearing With Examples

According to the formula for calculating return investment ratio the return on investment ROI is calculated as Earnings Initial Investment Initial Investment x.

. Yearly Rate of Return EYP BYP BYP x 100 is the formula for. Ad These Top Brokerages Offer Tools For New Investors And Those With Years Of Experience. Using the formula above we would calculate the ROI as follows.

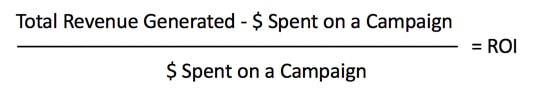

Return on Investment can be defined as the ratio of a profit or loss made in a fiscal year expressed in terms of an investment when return is given is calculated using Return on. Use the calculation for the yearly rate of return. The basic ROI formula is.

Ad With a Focus on Client Goals American Funds Takes a Different Approach to Investing. ROI Net Return on Investment Cost of Investment100. Cost of Investment.

Return on Investment Investment Revenue - Cost of Investment Cost of Investment. The return on investment formula is mechanically similar to other rate of change formulas an example being rate of inflation. With that said the return on investment can be calculated by dividing the 20k net return by the cost of 80k which comes out to 25.

New And Experienced Investors Should Consider These Top-Recommended Brokerages. ROI 18000 200000 x 100 818. To get the percentage multiply the figure by 100.

Ad Put Your Investment Plans Into Action With Personalized Tools. Open an Account Today. The base formula for measuring a percentage rate of change.

ROI 20k 80k 025 or 25. The net profit from the expenses would be 200 and the Return on Investment can be calculated as below. ROI in contrast to ROE return on equity takes into account total investment expenditure ie.

To calculate this ratio you simply subtract the initial cost of the investment from. How to calculate return on. Ad Get the Top Priorities and Challenges of Alternative Investors During Recent Disruption.

So in the above example the. OR ROI Final Value of Investment Initial Value of InvestmentCost. Both owners and shareholders equity.

Within plus or minus one standard deviation are 68 of the data points 34 below and 34 above Within plus or minus two standard deviations are 95 of the data. Learn More About American Funds Objective-Based Approach to Investing. 200000 20000 220000.

While the numerator is pre-tax the metric is calculated post-financing so the annual cash flow is a levered metric. Cash-on-Cash Return Annual Pre-Tax Cash Flow Invested Equity. Discover the Shifts Occurring within Asset Classes in EYs Global Survey.

1

Roe Animal

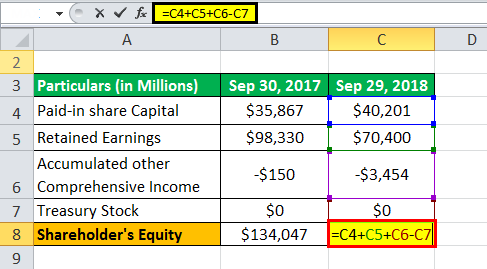

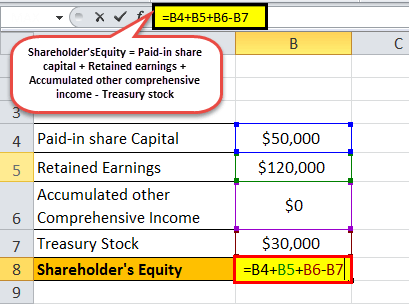

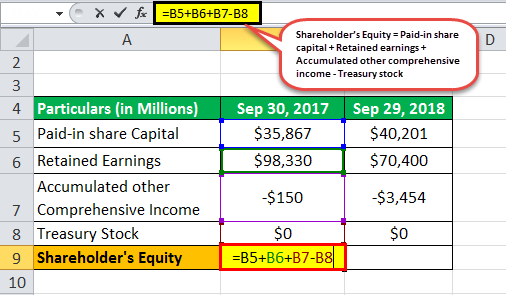

Shareholder S Equity Formula How To Calculate Stockholder S Equity

Profitability Ratios Calculate Margin Profits Return On Equity Roe

Shareholder S Equity Formula How To Calculate Stockholder S Equity

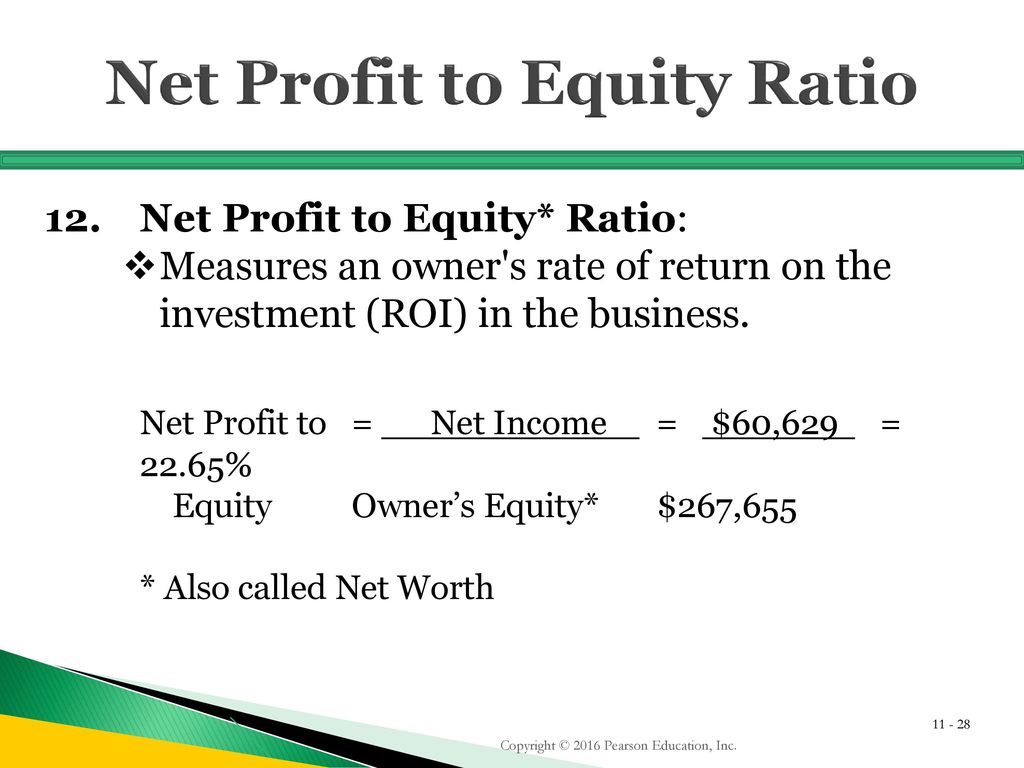

Copyright C 2016 Pearson Education Inc Ppt Download

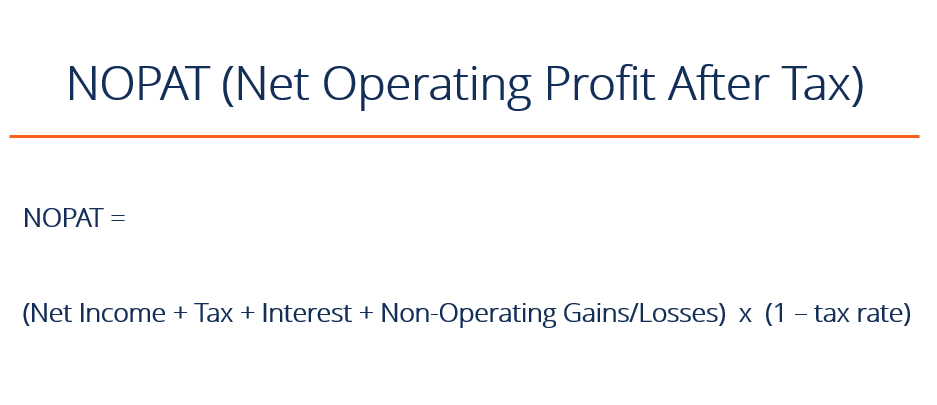

Nopat Net Operating Profit After Tax What You Need To Know

A Simple Way To Calculate Social Media Return On Investment Social Media Examiner Forex Internet Marketing Stock Trading

Return On Equity Roe Formula And Calculator Excel Template

Shareholder S Equity Formula How To Calculate Stockholder S Equity

1

1

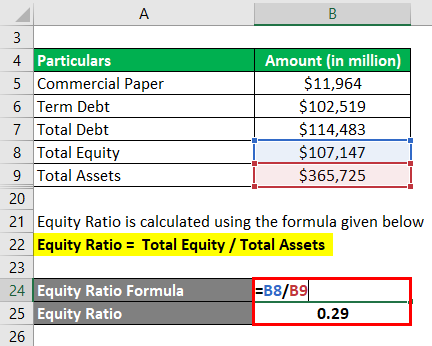

Gearing Formula How To Calculate Gearing With Examples

How To Identify Stocks To Avoid For Investment Investing Debt To Equity Ratio Stock Market

Gearing Formula How To Calculate Gearing With Examples

Medical Marketing Roi Calculator Example Recommended

Return On Equity Roe Formula And Calculator Excel Template